Why buy a new machine in 2017?

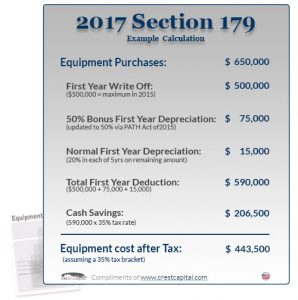

Savings, that’s why! The Section 179 is a tax code created to help businesses. Section 179 is a fantastic incentive for businesses to purchase, finance or lease equipment this year by allowing businesses to deduct the full amount of the purchase price of the equipment.

There is simply no better time than now to take advantage of Section 179 and Bonus Depreciation. Why? Because it is a Use-It-or-Lose-It write-off that ends December 31st, 2017.

All businesses that purchase, finance, and/or lease less than $2,000,000 in new or used business equipment during tax year 2017 should qualify for the Section 179 Deduction.

Guyson engineers, designs and builds surface finishing , parts-washing and advanced robotic machines. We also have a large variety of Wheel Blast Machines on hand, in addition to the tax incentive we are also offering a discount which makes this a great time to take advantage of these savings!